FAQs

Will the stock market crash in 2026 for sure?

No. Risks are high, but crashes are not guaranteed.

Is Warren Buffett expecting a 2026 crash?

He is cautious, not predicting a specific crash.

Should I stop investing before 2026?

Stopping SIPs usually hurts long-term returns.

Is India safe if US markets crash?

India may face volatility but has stronger fundamentals.

Is AI really a bubble?

AI is real, but expectations may be too high.

Will the stock market crash in 2026, or is this just fear talking?

Imagine this.

You open your portfolio app. Markets are near all-time highs.

Then you see YouTube thumbnails screaming “2026 CRASH.”

Buffett is holding cash. Ray Dalio is warning. Kiyosaki is panicking again.

And the question hits you hard.

Will the stock market crash in 2026?

This article helps you think clearly.

No hype. No panic. Just facts, data, and common sense.

Before we go deeper, here’s what we’ll answer.

Key questions this article will cover:

- Why are so many experts warning about a 2026 market crash?

- How serious is the US debt and AI bubble risk?

- What does Warren Buffett’s cash hoard really signal?

- Is India safer than global markets in 2026?

- What should a normal investor do right now?

Click here to explore all articles on FinanceWithXpert

Join our finance community:

Why are crash predictions for 2026 everywhere right now?

Crash warnings usually rise when markets feel expensive.

And today, valuations are stretched across global markets.

In 2025–2026:

- US markets are near record highs.

- AI stocks dominate index returns.

- US government debt is at historic levels.

This combination makes investors nervous.

Several well-known names have added fuel:

- Samuel Burner shared charts predicting a 2026 collapse.

- Robert Kiyosaki warned of a multi-decade bubble burst.

- Ray Dalio flagged a dangerous US debt cycle.

- Warren Buffett is sitting on massive cash.

Social media amplified these views.

Fear spreads faster than data.

But warnings alone don’t mean a crash is guaranteed.

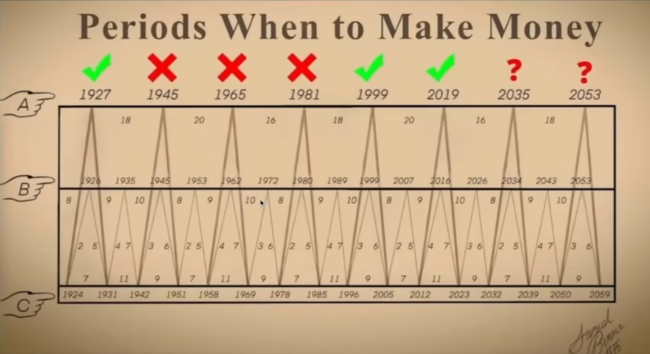

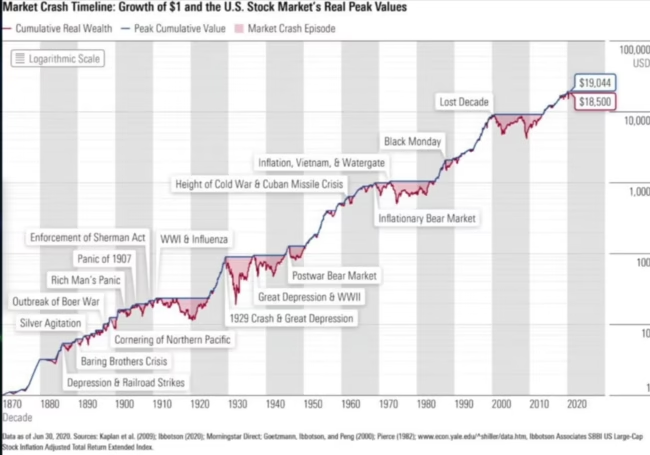

How reliable are historical crash prediction charts?

History shows a mixed record.

Some cycles worked. Others failed.

Samuel Burner’s chart points to past crashes:

- 2000 dot-com crash

- 2008 housing crash

- 2020 COVID crash

But similar warnings existed earlier:

- 1945

- 1965

- 1981

Those did not lead to crashes.

Reality check:

Market cycle charts have about a 50–50 success rate.

Markets often correct without crashing.

Timing remains impossible.

That’s why asking “Will the stock market crash in 2026?” has no certain answer.

Why is the US debt crisis seen as the biggest risk?

The US debt situation is real.

And it’s serious.

Key data (2025–2026):

- US national debt: $38 trillion+

- Interest costs rising fast

- Bond yields under pressure

Ray Dalio’s concern is simple.

If interest costs explode, the system breaks.

Here’s how it can hurt markets:

- Higher borrowing costs for companies

- Lower government flexibility

- Risk of money printing

- Loss of investor confidence

But timing matters.

Debt crises build slowly, then hit suddenly.

That uncertainty fuels crash fears.

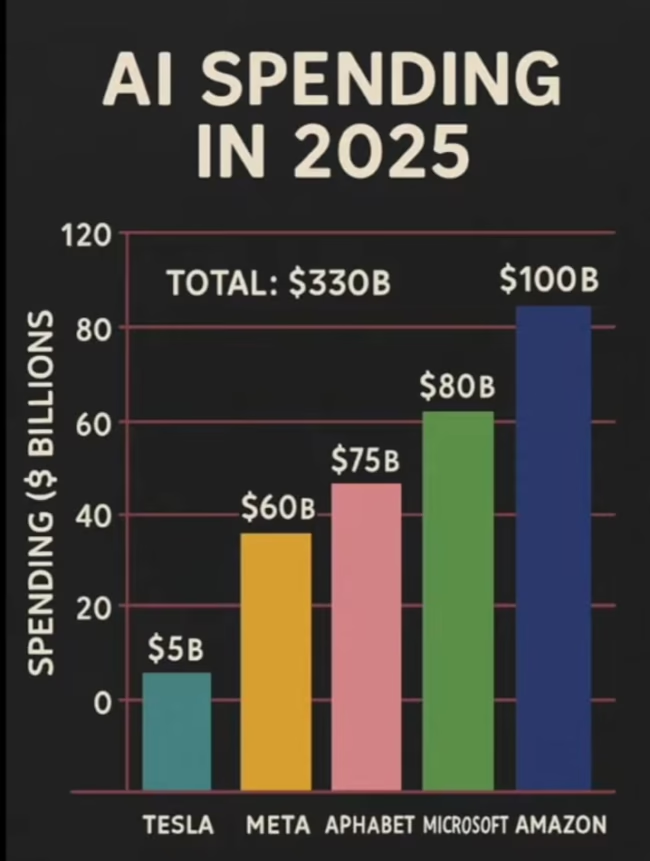

Is the AI bubble another dot-com moment?

AI is powerful.

But expectations are extreme.

The “Magnificent Seven” tech stocks drive most US market gains.

They have invested $300+ billion into AI infrastructure.

This creates a circular system:

- Tech firms fund AI

- Chipmakers sell to tech firms

- Data centers expand for tech firms

It works until growth slows.

Simple example:

Imagine a company expected to grow profits by 40%.

It delivers only 20%.

That’s still growth.

But the stock can fall sharply.

That’s the AI risk.

AI Bubble Risk Comparison

| Factor | Dot-Com (2000) | AI Era (2026) |

|---|---|---|

| Revenue | Mostly absent | Strong |

| Profitability | Weak | Strong |

| Valuations | Extreme | High |

| Survivors | ~40% | Unknown |

AI isn’t fake.

But prices assume perfection.

Many investors are now asking a deeper question – is there an AI bubble, or are markets simply pricing future growth too early?

What does Warren Buffett’s cash pile actually signal?

Buffett’s company is holding about ₹31 lakh crore in cash.

That’s historic.

Buffett’s pattern is clear:

- High cash when markets are expensive

- Low cash when markets crash

This doesn’t predict timing.

It shows caution.

Buffett knows markets can stay expensive for years.

But he also wants dry powder when fear returns.

This supports caution.

Not panic.

Does an inverted yield curve really signal a crash?

The yield curve matters.

An inverted yield curve means:

- Short-term rates are higher than long-term rates

Historically:

- Every US recession was preceded by inversion

- But not every inversion caused a crash

What it suggests:

Economic stress ahead.

What it doesn’t guarantee:

An immediate market collapse.

It’s a warning light.

Not a crash button.

Is India facing the same crash risk as the US?

India looks different.

Key positives for India in 2026:

- Strong corporate earnings

- Rural demand recovery

- Lower AI bubble exposure

- Positive long-term growth forecasts

Global investment banks remain bullish on India.

India vs US Market Risk (2026)

| Factor | US | India |

|---|---|---|

| Valuations | Very high | Reasonable |

| Debt risk | Severe | Manageable |

| AI bubble exposure | High | Low |

| Earnings growth | Slowing | Improving |

India’s main risks:

- Rupee weakness

- US trade tensions

- Global capital flows

But there’s no strong India-specific crash signal.

Should investors stop SIPs fearing a 2026 crash?

Stopping SIPs often hurts returns.

Markets reward patience.

Simple SIP example:

- ₹10,000 monthly SIP

- 10 years

- Market crash in year 6

Result:

- More units bought at lower prices

- Higher long-term returns

This is rupee cost averaging.

Trying to time crashes usually fails.

How can investors protect themselves without panic?

Preparation beats prediction.

Practical steps:

- Keep 20% cash for flexibility

- Continue SIPs

- Diversify across equity, debt, and gold

- Avoid leverage

- Review asset allocation yearly

Income-focused investors also look at real assets, and understanding how to reinvest REIT dividends India can help improve long-term portfolio stability.

And one thing many ignore.

Why is health insurance more important than market predictions?

A market crash hurts wealth.

A medical emergency can destroy it.

In India:

- Hospital bills can wipe out years of savings

- Insurance protects your base

Before worrying about “Will the stock market crash in 2026”,

make sure your family is financially protected.

At the same time, households should track interest rate changes, because How will RBI rate cut affect home loan EMI directly impacts monthly cash flow and long-term savings.

Markets recover.

Medical bills don’t.

So, will the stock market crash in 2026?

There are real risks.

- US debt

- AI valuations

- Global macro pressure

There are also real strengths.

- Corporate earnings

- India’s growth story

- Market adaptability

History teaches one lesson.

Crashes are obvious only in hindsight.

Smart investors don’t predict.

They prepare.

Key Takeaways

- Crash predictions for 2026 are based on real risks, not certainty.

- US debt and AI valuations are the biggest global concerns.

- Warren Buffett’s cash signals caution, not a timing call.

- India looks relatively stronger than US markets.

- SIPs and diversification remain powerful tools.

- Health insurance is essential risk protection.

Final Thought

The real danger isn’t a 2026 crash.

It’s emotional decisions driven by fear.

Stay invested.

Stay prepared.

And think long term.

Click here to explore all articles on FinanceWithXpert, If you missed yesterday’s moves, this previous Indian stock market update today gives useful context on how sentiment shifted.

Join our finance community:

Disclaimer:

This article is for informational purposes only and not financial advice. Please do your own research or consult a financial advisor before investing

COMMENTS